how are annuities taxed to beneficiaries

Depending on. It depends on your contributions.

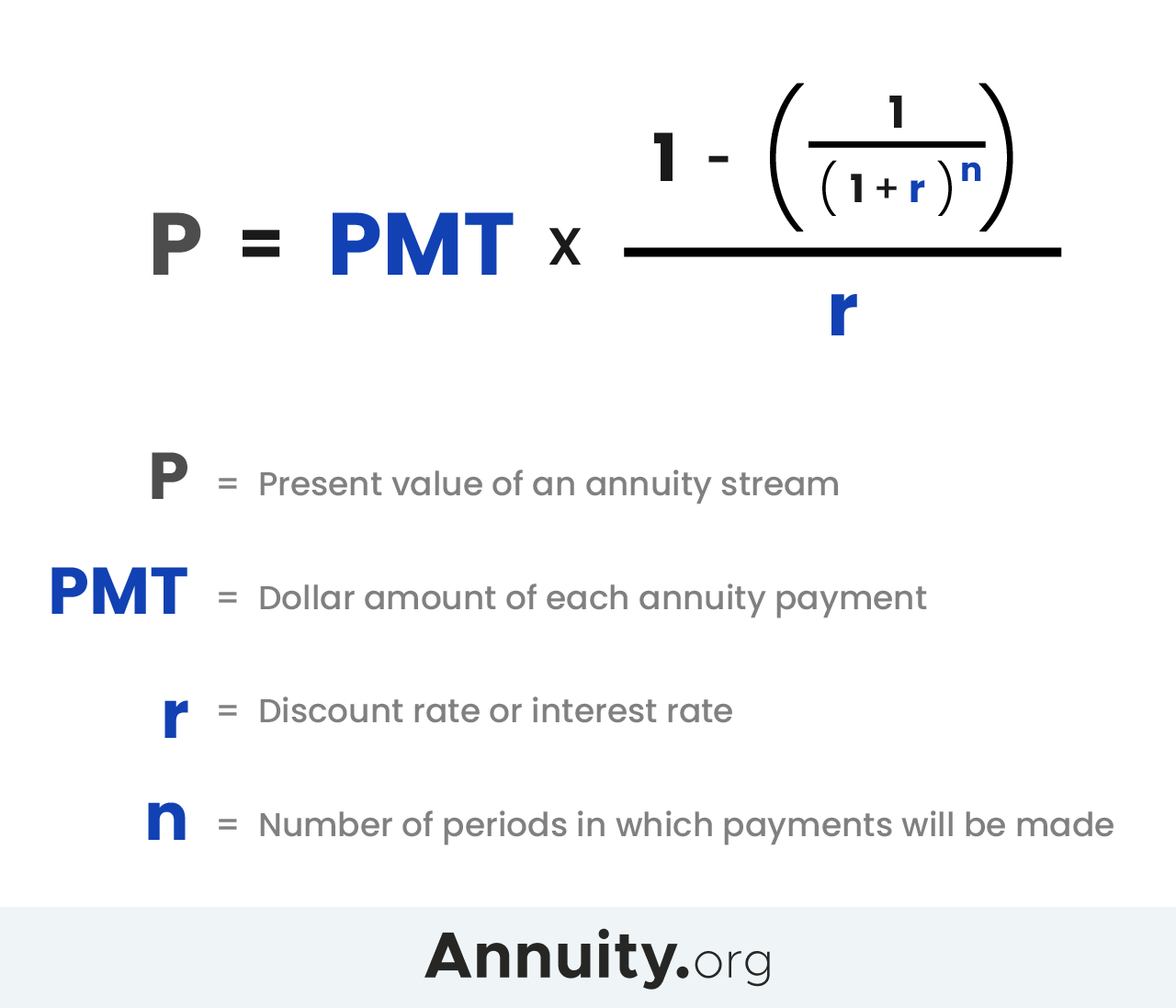

Present Value Of An Annuity How To Calculate Examples

Fact checked by.

. Learn some startling facts. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. Ad Learn More about How Annuities Work from Fidelity.

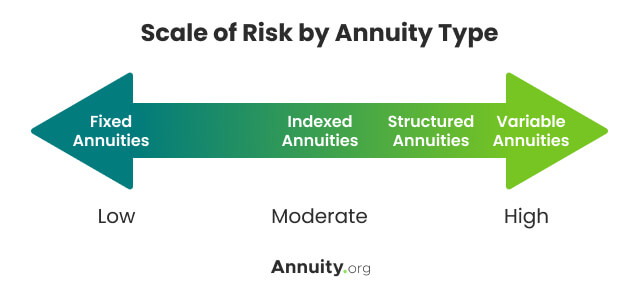

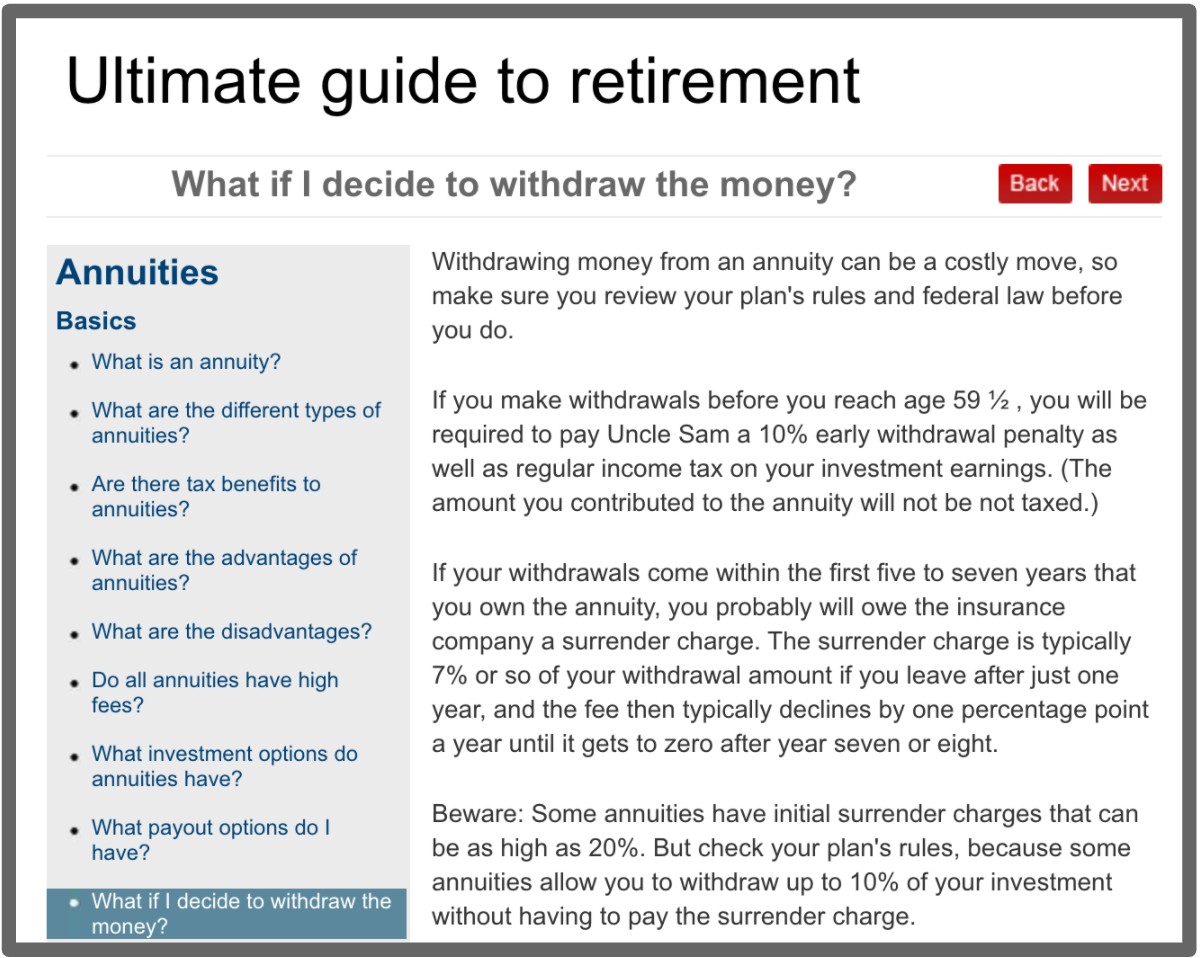

Annuities are insurance contracts that offer unique guarantees and tax deferral and they are commonly used to save for retirement. The bonus will offset the taxes owed. Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax.

Everything You Need To Know. For variable annuity contracts issued on or after 102979 and for all fixed annuity contracts there is no step-up in basis for income tax purposes and the beneficiary pays income tax on. Dont Buy An Annuity Without Knowing The Hidden Fees.

Just like any other qualified account such as a 401 k or an individual. If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies. Take a Closer Look at the Main Types of Annuities Common FAQs.

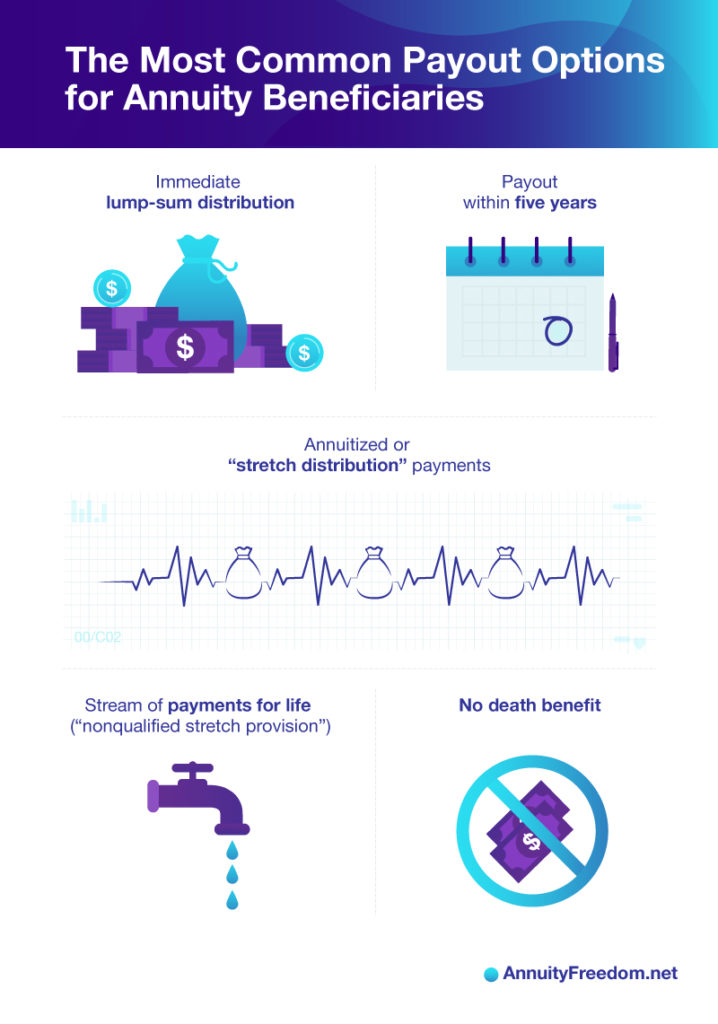

Ad See If An Annuity Is Right For You. The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit. Your relationship to the beneficiary matters when it comes to annuity payments and taxation so.

A beneficiary can reinvest the inheritance with a deferred annuity that offers a premium bonus. Taxes and Annuity Payouts. Beneficiaries of a trust typically pay taxes on the distributions they receive from the trusts income rather than the trust itself paying the tax.

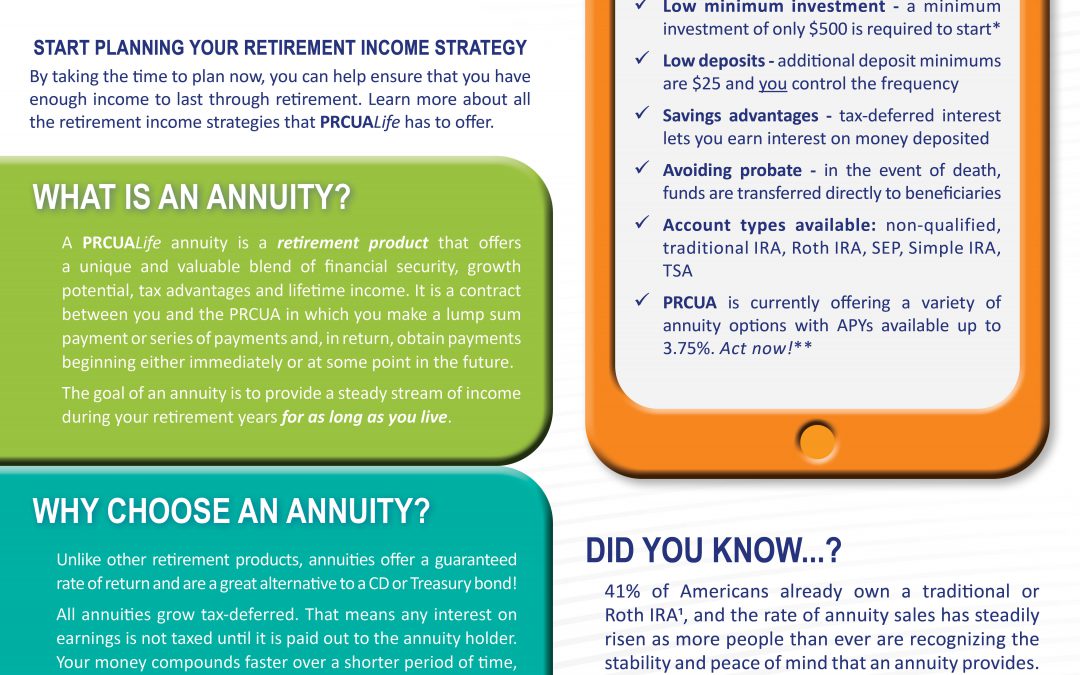

Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market. FindInfoOnline Is The Newest Place to Search. Annuities are designed to build wealth and income for your retirement through tax deferral.

Ad Search For Are Inherited Annuities Taxable. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. This so-called inherited annuity is the.

Get this must-read guide if you are considering investing in annuities. When an annuity owner dies the person or people identified as beneficiaries receive the annuity balance and must pay taxes on that amount. Interest earned in a deferred annuity the most popular type is not taxed until.

Ad Learn More about How Annuities Work from Fidelity. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. But this is not the case when inheriting an.

Find Useful And Attractive Results. Beneficiaries of Period-Certain Life Annuities. Taxes at Death.

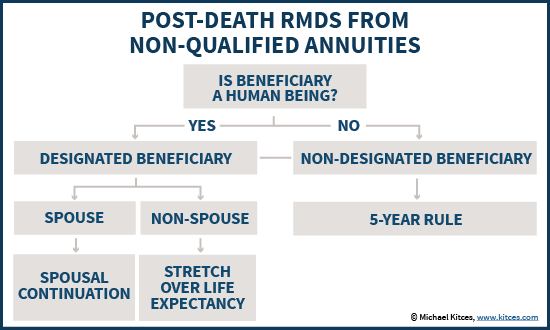

These payments are not tax-free however. Ad Earn Lifetime Income Tax Savings. How are non qualified annuities taxed to beneficiaries.

Tax Benefits for Annuity Beneficiaries. In most cases non-qualified annuities can remain tax deferred all the way until the death of the owner. If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery.

Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by. Ad Annuities are often complex retirement investment products. Give Gain With CMC.

Annuities are popular investments because the earnings are tax-deferred until. Ad True Investor Returns with No Risk Find Out How with Your Free Report Now. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments.

Considering the Beneficiary of Your Annuity. When an annuity payment is made 50 of each payment would be income taxable. For example if the.

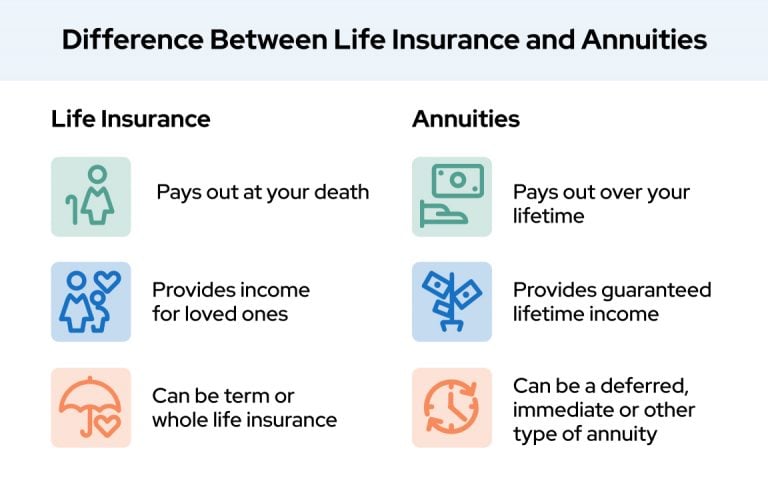

When an individual inherits a life insurance policys death benefit they typically will not have to pay any income taxes.

Annuity Taxation How Various Annuities Are Taxed

Life Insurance Vs Annuity How To Choose What S Right For You

Financial Blog Archives Prcualife

Annuity Beneficiaries Inherited Annuities Death

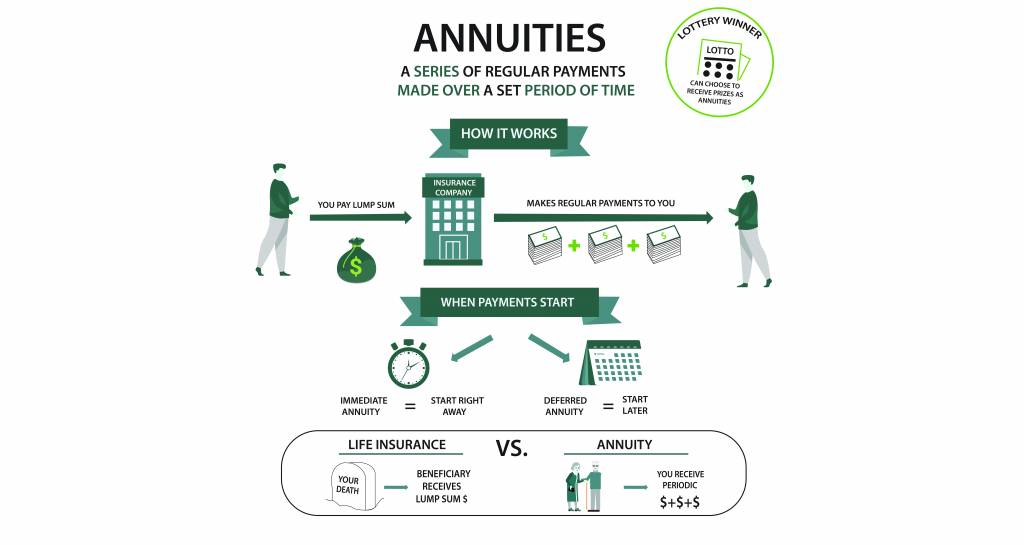

What Is An Annuity Definition How Annuities Work Pros Cons

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Beneficiaries Inheriting An Annuity After Death

Annuities What They Are And How They Work Nextadvisor With Time

Annuity Taxation How Various Annuities Are Taxed

Using Annuities For Spendthrift Protection In Estate Planning

Annuity Beneficiaries Inheriting An Annuity After Death

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Indexed Annuity Performance Examples Hyers And Associates

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Contracts For Investment Or For Creating Income Stream

Understanding The Different Values In Annuities The Annuity Expert